Twinkies have been around more than eighty years and during that time they’ve become something of a cultural icon. In the recent blockbuster hit, Zombieland, there is a comedic interplay between the gruff main character, Tallahassee, and his affectionate nostalgia for the childhood treat. Even President Bill Clinton is reported to have placed a Twinkie in a time capsule as a child.

Unfortunately for Twinkie lovers everywhere the Hostess company has not been doing well. This Chapter 11 case is its second in the last few years and it still remains $860 million in debt. Informally, two quick Chapter 11 bankruptcies are called a, “Chapter 22”. A “Chapter 22” is generally done when a business is going to be completely liquidated, which I don’t believe is the case with Hostess. Movie Gallery Inc. and Polaroid Corp., were forced to liquidate upon their second Chapter 11, but two more obscure companies, Hayez Lemmerz International and Pliant Corp., an auto and packing company respectively, survived multiple bankruptcies.

If Hostess is liquidated, it’s assets will be sold to the highest bidder. This fact alone will not mean the end of the iconic Twinkie. Whoever buys the Twinkie rights will likely produce it just as we remember. Hopefully for Hostess, they’re successful in avoiding liquidation, but either way, I think we’ll see our beloved Twinkie around for another 80 years.

Mortgage Debt Relief Act of 2007 set to expire

The Mortgage Debt Relief Act of 2007 was enacted as a response to the growing foreclosure problem. More specifically, it addresses the issue of “Debt Forgiveness Income.” Debt Forgiveness Income is an IRS theory that if a debt you owe is forgiven, you have gained in monetary value because you no longer are required to pay that debt. That gain in value is taxable as income despite the fact that you didn’t actually earn any money. For example: Stephen owes $5,000 in old medical bills. He can’t pay the bills, so the hospital forgives the debt and writes it off on their taxes. Come tax time, he will receive a Form 1099 for $5,000 of additional, previously untaxed, income for that year. Now, $5,000 may not be too much of a problem, even in the highest tax bracket this would only increase his taxes by $1,750, the trouble starts when the amount forgiven is higher, as it is with a house.

The Mortgage Debt Relief Act of 2007 was enacted as a response to the growing foreclosure problem. More specifically, it addresses the issue of “Debt Forgiveness Income.” Debt Forgiveness Income is an IRS theory that if a debt you owe is forgiven, you have gained in monetary value because you no longer are required to pay that debt. That gain in value is taxable as income despite the fact that you didn’t actually earn any money. For example: Stephen owes $5,000 in old medical bills. He can’t pay the bills, so the hospital forgives the debt and writes it off on their taxes. Come tax time, he will receive a Form 1099 for $5,000 of additional, previously untaxed, income for that year. Now, $5,000 may not be too much of a problem, even in the highest tax bracket this would only increase his taxes by $1,750, the trouble starts when the amount forgiven is higher, as it is with a house.

If Stephen’s home is foreclosed upon and the bank forgives a $50,000 debt, he will owe taxes for his actual annual income, plus this $50,000. You could’ve argued that $5,000 wouldn’t effect what bracket he was in before, but $50,000 is almost certain to increase his tax bracket and will leave him with a minimum of $12,500 in additional tax debt. As a result, Stephen may be in debt for a long time. If he didn’t have the money to pay his mortgage, it doesn’t make sense that he’d have enough money to pay the taxes.

It was because of Stephen’s scenario that the Mortgage Debt Relief Act of 2007 was passed. The act allows a person whose homestead has been foreclosed on to have his debt forgiveness income waived so long as it is less than a million dollars per year.

How Anna Nicole Smith Altered Bankruptcy Jurisdiction

Being married to a billionaire did little to prevent Anna Nicole Smith from filing a Chapter 11 bankruptcy. When she did, her son in law, E. Pierce Marshall, filed a claim in her bankruptcy case for defamation of character. His claim was based on her suing him for tortuous interference with an expectancy interest i.e., unduly convincing his father to disinherit her.

E. Pierce Marshall had originally filed suit in Texas state court but Smith filed bankruptcy in California federal court. Each court made independent decisions of their own and the Supreme Court eventually was required to hear the case to determine which court had jurisdictional authority to hear the cases already decided.

It was found that while the bankruptcy court has statutory authority to hear non-core (weakly related to bankruptcy) cases, they lack the constitutional authority to hear those cases. As such, the bankruptcy court could determine that Anna Nicole Smith had an interest in suing E. Pierce Marshall, but the court lacked jurisdiction to determine the amount of that claim. Resulting from this, Marshall was awarded the inheritance of his late father, but as he himself had also passed away, the property was given to his surviving spouse and children.

Capital One Financial Corp. allegedly makes 15,500 bogus claims

When someone files for bankruptcy protection they don’t expect to have their discharged bills come back to haunt them. Zombie debts are not unheard of, but are rarely seen in the multitude that has been alleged against Capital One by a court-appointed monitor. Some of these debts, including one sought fourteen years after it was discharged, are for thousands of dollars.

When someone files for bankruptcy protection they don’t expect to have their discharged bills come back to haunt them. Zombie debts are not unheard of, but are rarely seen in the multitude that has been alleged against Capital One by a court-appointed monitor. Some of these debts, including one sought fourteen years after it was discharged, are for thousands of dollars.

Unlike most lenders, Capital One handles most of it’s debt collection internally, rather than outsourcing to collection firms. This may be part of their problem as collection firms are usually well versed in the Fair Debt Collection Practices Act.

Out of the 15,500 bogus claims made by Capital One only about 800 of those borrowers filed lawsuits against the creditor. 130 of these cases were settled without Capital One admitting fault. Not all attorneys will file suit against a creditor for attempting to collect a discharged debt, but it’s important that debtors know that they can. Without the remedy of suing the creditor, there would be little to no use of the bankruptcy court at all.

Private Student Loans – The Bane of Bankruptcy Protection

One of the worst things I see happening to the youth of America is caused by their pursuit of education. From kindergarten through high school every student is instilled with the mantra, “Go to College” or the classic, “If I could go back in time I’d study harder.” Not to say that higher education is inherently bad, obviously, I chose to take that path myself. No, it’s not the education that causes a problem, it’s the loans taken out to pay for that education that’s a problem.

These loans wouldn’t be a problem if the income from the jobs that followed the loans was sufficient to pay the debts. The problem graduates are facing is that those jobs either don’t pay enough to make the monthly loan payments or the jobs don’t exist at all.

Fortunately, for those with federal loans there are programs like Income Based Repayment. Income Based Repayment or IBR, allows graduates in the private sector to pay a monthly payment based on a percentage of their gross income. After 25 years of payments, the remaining debt is discharged. Some people feel that this is unfair because those people signed into those debts with knowledge of the interest rates. There is truth in that, however most, if not all of those students did not anticipate the economic collapse of 2007.

How does inheritance relate to a Bankruptcy case?

Inheritance can be an issue in bankruptcy law. One might think that after you receive a discharge in your bankruptcy case, your case is done and the court does not have an interest in your finances. This is not always so.

In a Chapter 7 case, if a loved one dies and leave you an inheritance within 180 days from the date of filing your case, then this money becomes part of your bankruptcy estate. The trustee may want some or all of the inherited funds to distribute to creditors. The important thing to remember is that the date that you become eligible for the inheritance that is the date to use in this 180 day analysis. This is the date of the loved one’s death, not when you actually receive the money or property.

In a Chapter 13 case there is an ongoing obligation to keep the trustee appraised of what property you own. Once they learn of an inheritance, they will likely take those funds for the benefit of your creditors. This can occur any time during the case. Since Chapter 13 cases are often as long as five years, it is important to make arrangements with relatives who may pass on during this time.

What Kinds Of Questions Will The Trustee Ask At A 341 Meeting Of Creditors?

If you file for Chapter 7 or Chapter 13 bankruptcy, you must attend a 341 Meeting of Creditors at the federal courthouse. This is a hearing with the trustee, and any creditors are invited to attend, though usually they decline to. You will be put under Oath and asked to produce a photo I.D. and social security card. Then the trustee will ask you some questions. Here are some sample questions that a trustee might ask.

1. Are you personally familiar with the information contained in the petition, schedules, statements and related documents? To the best of your knowledge, is the information contained in the petition, schedules, statements, and related documents true and correct?

2. Are all of your assets identified on the schedules?

Sears and Kmart to Close 100+ Stores

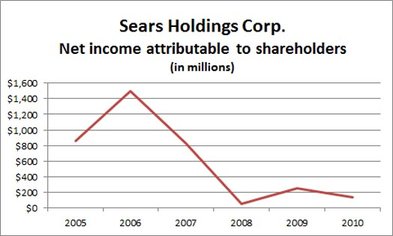

With shares dropping 50% from last year, it comes as no surprise that Sears Holdings Corp., which owns both Sears, Roebuck & Co. and Kmart Corp., is closing stores more than 100 stores. The graph above shows a 84% decrease in income for the company since it first acquired Kmart.

The fall is an interesting development coming on the heels of Sear’s CEO Edward Lampert pay out of a record $1 billion dollar income in 2004.

It is impossible to tell what the future holds for these companies, but I speculate that they will eventually file a Chapter 11 (Kmart did a few years ago) or that the company will be divided into smaller parts, Lampert selling off the less profitable portions and attempting to recover on the more profitable ones. Unfortunately, the brunt of the fall will be felt by the employees, who will lose their jobs and may be forced into bankruptcy themselves. Lampert, with a one year income of over a billion dollars, probably won’t be so unfortunate.

Common Bankruptcy Myths

As is most legal processes, bankruptcy can be a difficult thing to maneuver. There is a lot of misinformation out there, you need to be careful to get your information from a trusted source. Here are some myths regarding bankruptcy:

Myth 1: If I file for bankruptcy, everyone will know.

Like most legal proceedings, most bankruptcy documents are public record. Since I work at a law firm in the bankruptcy department, I search these records all the time. I even have a special username and password that allows me access online. However, how many times do you think your friends, family, or co-workers search through federal court records? The truth is that while your bankruptcy documents will be public information, it is unlikely that those you know would search to find them.

The Automatic Stay

Upon filing for bankruptcy protection, an automatic stay is put in place. This means that creditors can not try and collect from you. So a creditor cannot call you to request payment, send bills to you, garnish your wages anymore, or repossess your car without court permission. If there is a foreclosure suit against you, that suit must also stop immediately. If your home is sold and you filed prior to the sale, that sale can be vacated. Obviously, this is a powerful tool bankruptcy. Many people file to stop creditors from taking actions against them or their property.

Upon filing for bankruptcy protection, an automatic stay is put in place. This means that creditors can not try and collect from you. So a creditor cannot call you to request payment, send bills to you, garnish your wages anymore, or repossess your car without court permission. If there is a foreclosure suit against you, that suit must also stop immediately. If your home is sold and you filed prior to the sale, that sale can be vacated. Obviously, this is a powerful tool bankruptcy. Many people file to stop creditors from taking actions against them or their property.

The automatic stay will remain in effect until one of the following things occurs:

1. A creditor petitions the court for relief from automatic stay and the court enters an order granting it;