It has been slightly more than three years to the day since Chrysler LLC and Fiat S.p.A. agreed to form an alliance. That alliance wasn’t formally announced until Chrysler’s bankruptcy, later that year. Fiat bought out a large chunk of Chrysler Group, approximately 30%, and reports it’s eventual goal to be 51%, however cannot make this purchase until Chrysler’s debts to the U.S. Government are repaid. That being said, Chrysler Group has reported a profit this year of $183 million which is a huge improvement over the $652 million loss in 2010. My first thought when reading this is that I ought to go buy some stock, but apparently it’s not currently publicly traded.

It has been slightly more than three years to the day since Chrysler LLC and Fiat S.p.A. agreed to form an alliance. That alliance wasn’t formally announced until Chrysler’s bankruptcy, later that year. Fiat bought out a large chunk of Chrysler Group, approximately 30%, and reports it’s eventual goal to be 51%, however cannot make this purchase until Chrysler’s debts to the U.S. Government are repaid. That being said, Chrysler Group has reported a profit this year of $183 million which is a huge improvement over the $652 million loss in 2010. My first thought when reading this is that I ought to go buy some stock, but apparently it’s not currently publicly traded.

It will take a few good years of profit to get the company on the solid ground upon which it once stood, but this is certainly a good start. It inspires hope in those who have gone bankrupt and it helps produce more jobs for Americans.

If you are considering bankruptcy and have questions, please contact a Jacksonville Beach Bankruptcy Attorney or call us at (904) 685-1200 for a free consultation.

Articles Posted in Cars & Vehicles

Craming-Down Negative Equity in Vehicles Goes Further

When you finance a car, it’s accompanied by a note and there’s a monthly payment. The note gives the seller security, as they now have recourse if you don’t pay -they can repossess the vehicle. This system is good for the seller because their money is backed by an asset instead of backed by your credit score. You can damage a credit score, but you can’t repossess a credit score and sell it to someone else.

When you finance a car, it’s accompanied by a note and there’s a monthly payment. The note gives the seller security, as they now have recourse if you don’t pay -they can repossess the vehicle. This system is good for the seller because their money is backed by an asset instead of backed by your credit score. You can damage a credit score, but you can’t repossess a credit score and sell it to someone else.

Ideally, the payment on the vehicle is based on the predicted future value of the car. If the car costs $10,000 today and will only be worth $2,000 in eight years, your payments over the eight years need to add up to $8,000 to keep the value balanced to the payments (I left interest out to make it less complicated). However, in some instances where the buyer’s credit is good the seller can offer the vehicle at a lower monthly payment despite knowing that the vehicle will be worth less than is owed on it. This is called negative equity. Eventually, that vehicle dies and the buyer is forced to purchase another car, still owing on the first. Instead of having a buyer who is unable to make two car payments, the new financing company offers to pay off the first car and roll the debt from it over into the new car’s note. Over time this vehicle gets more and more underwater and eventually the debtor is forced to file bankruptcy.

A “Cram-Down” occurs when a debtor asks the court to determine the value of their vehicle and to make this value the secured amount of the debt. i.e. if the debtor owes $10,000 on a vehicle, but it is now only worth $2,000, the court can lower the secured amount owed to $2,000. The remaining $8,000 becomes unsecured. This can be done in both a Chapter 7 or a Chapter 13 bankruptcy. However in a Chapter 7 the $2,000 has to be paid immediately, so it is less practical than in Chapter 13 where the debtor has several years over which to make payment.

Bankruptcy Petition Preparers In Big Trouble With The Court

Two bankruptcy petition preparers in Wisconsin are in big trouble with the Court, facing possible criminal charges. Jennifer Abbott, who is a disbarred attorney, was cited with contempt by a bankruptcy judge. The Court said that she has violated bankruptcy Court Orders repeatedly and she refused to obey a subpoena issued by the U.S. Trustee’s office. Abbot has also been convicted of felony theft for stealing from a client.

The second bankruptcy petition preparer, Gaynor Morrison, is in trouble for failing to appear in bankruptcy Court when ordered to do so. Also, he was alleged to have been overcharging clients and failed to return fees to clients after being ordered to by the Court.

Bankruptcy petition preparers are non-attorneys who help people file for bankruptcy. Courts and trustees often comment that the petitions or other required documents are flawed when drafted by a bankruptcy petition preparer. If this happens and the case gets dismissed without discharge, people could lose valuable assets or have to pay additional filing fees. Not all bankruptcy petition preparers are unprofessional, but it is best to have a licensed attorney with knowledge of the complexities of the Bankruptcy Code prepare your bankruptcy documents. To contact a Jacksonville Bankruptcy Attorney today, call 904-685-1200.

Saab files for Bankruptcy

The first automobile company to come up with heated seating has filed for bankruptcy in it’s home country of Sweden. Although it began as an aircraft manufacturer, Saab entered the growing automobile market after World War II. Saab sales peaked in 1988 at sales of nearly 135,000 and nearly returned to that peak in 2006. USA Today’s, data shows a decline in Saab sales by 20.3% from 2006 to 2009.

The first automobile company to come up with heated seating has filed for bankruptcy in it’s home country of Sweden. Although it began as an aircraft manufacturer, Saab entered the growing automobile market after World War II. Saab sales peaked in 1988 at sales of nearly 135,000 and nearly returned to that peak in 2006. USA Today’s, data shows a decline in Saab sales by 20.3% from 2006 to 2009.

According to Inside Line, the Swedish Company Reorganization Act requires that a bankruptcy application be approved only if there is reasonable cause to assume that the purpose of the reorganization will be achieved. Since the purpose of this reorganization is to keep the company running, it will be interesting to see what transpires.

Of course, the worst of the impact of a corporate bankruptcy is borne by the employees of the company. BBC News reports that Saab’s employes have complained that they’ve not been paid since last month. Since corporate bankruptcies often take months (if not years) to complete, it’s hard to imagine just how many personal bankruptcies this corporate one will cause.

Redemption: A Unique Way For Married Jacksonville Residents to Keep Their Vehicles

Jacksonville residents have several options when it comes to dealing with secured assets when filing bankruptcy. They can redeem the property by paying the creditor it’s fair market value, reaffirm the debt by offering the creditor the same loan terms or surrender the item by giving it back to the creditor.

Jacksonville residents have several options when it comes to dealing with secured assets when filing bankruptcy. They can redeem the property by paying the creditor it’s fair market value, reaffirm the debt by offering the creditor the same loan terms or surrender the item by giving it back to the creditor.

Redemption is an attractive choice for debtors because it allows them to pay what a secured asset is worth instead of what they owe on it. There can be a significant savings here as vehicles plummet in value as soon as they roll of the car lot. However, there are two conditions precedent that often get in the way.

First, if the car is being used for personal consumer use, the date of purchase (or refinance), must be longer than 910 days before filing the bankruptcy to redeem. If the car was purchased for business use, there is no waiting period. The second, and more difficult issue, is that the money to pay for the vehicle’s value must be paid for at the time of redemption. This is a problem because the debtors are bankrupt and rarely have enough cash to meet the payoff amount.

Jacksonville Trucking Company, Trailer Bridge, Files Bankrutpcy

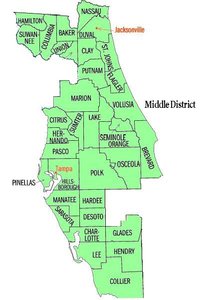

Florida was hit harder than most states when the recession of 2007 hit. The so named, “Middle District” being the third highest rate in the nation from mid-2010 to mid-2011.

Florida was hit harder than most states when the recession of 2007 hit. The so named, “Middle District” being the third highest rate in the nation from mid-2010 to mid-2011.

As a result, it’s no surprise that Trailer Bridge, a local trucking and shipping company, filed for Chapter 11 bankruptcy reorganization yesterday. Truckers have been hit hard by the economic downturn and several of them are seeking loan modifications on their trucks. In a Chapter 13 reorganization, the secured amount owed on a truck can be reduced to what it’s fair market value is on the date of filing rather than what the driver actually owes in the contract. This method is called, “Redemption“. The loan new amount is also re-amortized to five years so that the driver leaves the bankruptcy owning the vehicle free and clear.

If you would like to learn more about “Redeeming” a vehicle, contact a Jacksonville Bankruptcy Attorney or call us at (904) 685-1200 to schedule a free initial consultation.

Must I Reaffirm My House And Car When I File For Chapter 7 Bankruptcy?

A reaffirmation agreement is an agreement between you and the creditor that holds a secured lien on collateral that you have previously purchased. This reaffirms the debt that you owe the creditor. So if you own a car and you file Chapter 7 bankruptcy, you can either surrender the collateral (give it back to the creditor), redeem the collateral (refinance through another company), or you can reaffirm the collateral by signing a reaffirmation agreement with the creditor and filing it with the court. This reaffirmation agreement basically says that you will be responsible for the debt just as you were before you filed the bankruptcy. If you do not do one of the above options, the creditor can repossess your vehicle.

As for your home, In re: Linderman dictates that you must also do one of the above options for your real property. So if you file a Chapter 7 bankruptcy and want to keep your home, you must sign a reaffirmation agreement with your mortgage company.

If you need help with your bankruptcy or want to know how to file a reaffirmation agreement, contact a Jacksonville Bankruptcy Attorney today.

Secured Assets in Bankruptcy

Debtors have three options when it comes to secured assets in a Chapter 7 bankruptcy. The first option may be the most obvious: Surrender. The option of surrender gives the debtor the ability to simply give up their interest in the secured property and pass it back to the creditor.

The next option is to Reaffirm. To Reaffirm a debt, the debtor offers the creditor a contract to allow the debtor to keep the property, often with the same terms as the original agreement. This allows the obligation to “go through” the bankruptcy and often enables debtors to keep their financed cars or homes. However, it is important to note that it is up to both the creditor and debtor to come to this agreement. If for some reason the creditor doesn’t want to reaffirm the debt, no one can make them. For this reason I make sure to advise my clients to be sure they’re up to date on all payments on these secured items going into the bankruptcy to induce the creditor into agreeing. Typically, these agreements do work out.

The final and least used option is Redemption. Redemption is the debtor’s right to purchase the secured property for it’s fair market value at the time of filing. It is important to note that this is not the agreed upon amount in the contract. You may owe $3,800.00 on a car, but if it’s only worth $1,000.00 on the day you file, you can pay the $1,000.00 and satisfy the debt to the creditor. The problem with this option, which is why it’s least used, is that very few people who are bankrupt can come up with the additional money. Still, it is better to have options you have little chance of using than have no options at all. I have also heard of some third-party financing companies who will pay off your Redemption amount if you sign a secured note with them. I have never actually seen this work out for the debtor and it seems counter-intuitive to begin a bankruptcy with a new debt, but as I said before, options are good.

Continue reading →

Chapter 13 “Cram-Down”

There are four Chapters in bankruptcy available to individuals, they are Chapters 7, 11, 12, and 13. Chapter 11 is usually associated with big businesses, like Winn Dixie did a few years ago. Chapter 12 rarely used and is specially formulated for “Farmers and Fishermen”. So it’s Chapters 7 and 13 that people usually think of when they think of bankruptcy.

Many people coming into my office have done some research and because they’ve discovered that there are payments required in a Chapter 13, they instantly decided that Chapter 7 is best for them. Chapter 7 may be a quicker and less expensive bankruptcy, but it often means liquidating your unexempt assets and surrendering any secured assets whose payments are behind.

Chapter 13 offers some forms of relief that aren’t available in Chapter 7. The Chapter 13 gives a debtor the opportunity to “catch up” on any mortgage arrears they have by spreading the amount owed over a five-year period.

There is also the opportunity of re-classifying “secured” second and third mortgages as “unsecured” debts in a process called, “Lien Stripping”. This would mean that after making five years of payments toward your unsecured creditors, the remainder of that second mortgage is discharged in the same way a credit card debt would be. This can be a huge advantage for some people.

Another valuable option in a Chapter 13 is the “Cram-Down” option under 11 USC § 506, which allows debtors to “cram down” the secured amount of a debt on a vehicle or other property under the right circumstances. This has been hugely advantageous to some truck drivers who have very large “secured” notes on trucks whose values have diminished over the years faster than the amounts owed on them.

Continue reading →

NFL Star In Trouble In His Chapter 7 Bankruptcy

NFL Star Rick Sanford initially filed for Chapter 7 bankruptcy in February 2009 in South Carolina. Sanford did not list all his assets, however. He failed to disclose his interest in a Colorado condo, which later sold, netting him $70,000.00. When the trustee in Sanford’s case challenged his listing of assets, Sanford withdrew his bankruptcy petition. He was subsequently charged with fraud and plead guilty. The court sentenced him to 2 years probation, 30 days home confinement, and 100 hours of community service.

When filing for bankruptcy, it is very important to be honest and list all of your assets. Oftentimes, your Jacksonville Bankruptcy Attorney can exempt your assets so you can keep them away from creditors.

Jacksonville Bankruptcy Lawyer Blog

Jacksonville Bankruptcy Lawyer Blog