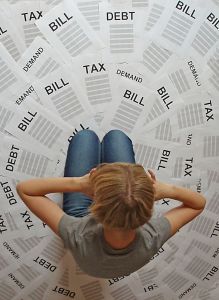

The news these days is all about Coronavirus: from television news to social media, the number one topic of the day is COVID-19. Our screens and feeds are flooded with news about how Coronavirus has devastated the American economy. Just this morning, NBC News had the “breaking” news that U.S. gross domestic product (GDP) fell by 4.8% in the first quarter of the year–the biggest decline since the Great Recession. This is probably is not much of a surprise to most of us. Economists predict that the worst is yet to come. Nearly Americans know that the economy has slowed down since millions of us have been laid off, furloughed, or had our incomes slashed. People without jobs and people worried about losing their jobs don’t have money to spend or are hesitant to spend it . Because of this uncertainty, consumer confidence plunged in April.

Many Floridians are worried about how they will pay for necessities like housing, food and transportation. By now, most Americans who are eligible to receive the Coronavirus Aid, Relief, and Economic Security (CARES) Act Stimulus payments have received their money. In Jacksonville, there will soon be an additional $1,000 available to each Jacksonville household that earns under $75,000 and can show they’ve taken a 25% income loss due to coronavirus. This program will be run by the city of Jacksonville, but funded by the Federal Government. The city will be issuing payments cards to 40,000 households. One household member must apply for the assistance online or by phone and then go downtown in person (the Main Library on N. Laura Street or the Ed Ball Building on N. Hogan Street) to an appointment to receive the payment. You will go to an auditorium, while practicing social distancing.

In order to get an appointment, residents must show that they had employment as of February 29, and that the Coronavirus epidemic caused them to lose at least 25% of their income. This test should be easy to meet for “non-essential” workers, who lost jobs or income because of the governor’s or mayor’s mandated shutdown. City Council President Scott Wilson said he expects the website to be up and running soon, and that “the goal is to start cutting checks — and what we’re going to do is give debit cards or credit cards, gift card type things — within the next seven days.”

Jacksonville Bankruptcy Lawyer Blog

Jacksonville Bankruptcy Lawyer Blog

The Federal Housing Finance Agency is reviewing a proposal that would permit Judges of Chapter 13 cases to give 0.00% interest rates on FHFA loans during the duration of the five year cases. Since about 90% of all U.S. Mortgages are FHFA backed, this would allow nearly all mortgages to have zero interest rates for five years. This comes on the heels of the

The Federal Housing Finance Agency is reviewing a proposal that would permit Judges of Chapter 13 cases to give 0.00% interest rates on FHFA loans during the duration of the five year cases. Since about 90% of all U.S. Mortgages are FHFA backed, this would allow nearly all mortgages to have zero interest rates for five years. This comes on the heels of the  Singer Beyonce Knowles, recently sold her Miami, Florida condo for nearly 25% of what she paid for it. According to

Singer Beyonce Knowles, recently sold her Miami, Florida condo for nearly 25% of what she paid for it. According to