When someone thinks of bankruptcy, one of the very first things that come to their mind is that they do not want to lose the property and assets they currently have. If you own property such as a home, vehicle, or any other property of value, you might automatically assume that bankruptcy is not an option for you because you will have to surrender your assets to your bankruptcy estate.

When someone thinks of bankruptcy, one of the very first things that come to their mind is that they do not want to lose the property and assets they currently have. If you own property such as a home, vehicle, or any other property of value, you might automatically assume that bankruptcy is not an option for you because you will have to surrender your assets to your bankruptcy estate.

However, you will be happy and surprised to learn that a Chapter 13 Bankruptcy might present some very unique opportunities for you that you were not previously aware of. For those of you facing financial difficulties while owning an investment property you do not want to lose, a Chapter 13 Bankruptcy might be the perfect solution for you.

You will be happy to know that under Title 11 of the United States Bankruptcy Code, Section 1322(b)(1), you can cram down a mortgage on an investment property. Cram down essentially means that if your mortgage is more than the fair market value of your investment property, then you can lower the principle balance of your mortgage to match the fair market value or secured value of the property. Basically, you can modify the mortgage’s contract by changing the principal balance, interest rate, and term. AND… the creditor cannot object to it. Continue reading →

Jacksonville Bankruptcy Lawyer Blog

Jacksonville Bankruptcy Lawyer Blog

When you finance a car, it’s accompanied by a note and there’s a monthly payment. The note gives the seller security, as they now have recourse if you don’t pay -they can repossess the vehicle. This system is good for the seller because their money is backed by an asset instead of backed by your credit score. You can damage a credit score, but you can’t repossess a credit score and sell it to someone else.

When you finance a car, it’s accompanied by a note and there’s a monthly payment. The note gives the seller security, as they now have recourse if you don’t pay -they can repossess the vehicle. This system is good for the seller because their money is backed by an asset instead of backed by your credit score. You can damage a credit score, but you can’t repossess a credit score and sell it to someone else. Jacksonville residents have

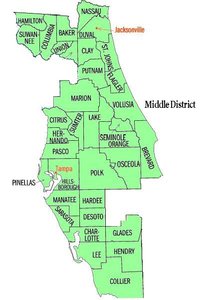

Jacksonville residents have  Florida was hit harder than most states when the recession of 2007 hit. The so named, “Middle District” being the

Florida was hit harder than most states when the recession of 2007 hit. The so named, “Middle District” being the  There are many reasons that it would be advantageous to file for bankruptcy, but here are some of the most common reasons:

There are many reasons that it would be advantageous to file for bankruptcy, but here are some of the most common reasons: