A 341 meeting, also known as the “Meeting of Creditors,” is held roughly 30 days after you file a Chapter 7 or Chapter 13 Bankruptcy. A lot of clients feel very intimated about the thought of this meeting, but in reality, it can be quite short and very easy. Of course, this depends all on how well your bankruptcy petition was prepared and how truthful you were in your petition. In short, if you were truthful on your petition and prepared it to the best of your ability, then you should have nothing to worry about and your 341 meeting should go very smoothly.

What is the purpose of the 341 meeting?

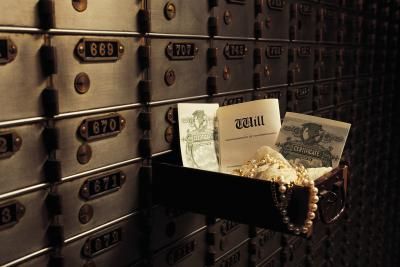

The original purpose behind the 341 meeting was to give your creditors the opportunity to scrutinize your affairs. In other words, it is your creditors opportunity to try to find any assets you have that can be sold by your Trustee and then the proceeds dispersed amongst your creditors. However, in reality, creditors rarely attend these 341 meetings. Instead, it is another opportunity for the Trustee to ask you questions about your petition and the financial documents you previously provided to your Trustee. The Trustee is in essence searching for any asset you may have omitted accidentally or on purpose that can be sold to pay your creditors. Again, if you prepared your petition truthfully, then the meeting should not last very long.

Questions the Trustee may ask you at the 341 meeting.

It is always much less stressful going into an unknown situation if you can prepare yourself for it. Therefore, below is a list of questions the Trustee may or may not ask you at your 341 meeting.

State your name and current address for the record.

- State your name and current address for the record.

- Please provide your picture ID and social security number card for review.

a. If the documents are in agreement with the § 341(a) meeting notice, a suggested statement for the record is:

“I have viewed the original state of ________ drivers license (or other type of original photo ID) and original social security card (or other original document used for proof) and they match the name and social security number on the § 341 (a) meeting notice.”

If the documents are not in agreement with the 341(a) meeting notice, a suggested statement for the record is:

“I have viewed the original social security card (or other original document used for proof) and the number does not match the number on the § 341(a) meeting notice. I have instructed the debtor (or debtor’s counsel) to submit to the court an amended verified statement by [date], with notice of the correct number to all creditors, the United States Trustee, and the Trustee, and to file with the court a redacted copy of the notice, showing only the last four digits of the social security number, and a certificate of service.”

When the documents do not match the petition, the Trustee shall attempt to ascertain why, and shall report the matter to the United States Trustee.

If the debtor did not bring proof of identity and social security number, the Trustee shall determine why.

Continue reading →

However, very recently I have had a lot of clients come to me very concerned and worried about this meeting. They want to know what to expect. The best thing you can do to be prepared is to know what types of questions the Trustee might ask you.

However, very recently I have had a lot of clients come to me very concerned and worried about this meeting. They want to know what to expect. The best thing you can do to be prepared is to know what types of questions the Trustee might ask you. Jacksonville Bankruptcy Lawyer Blog

Jacksonville Bankruptcy Lawyer Blog